Let’s face it, KYC is a necessary evil. One can’t imagine banks and stock exchanges not verifying their customers’ identities. This is vital in avoiding fraud, tax evasion, criminality, corruption and terrorist funding. Still, repeatedly fulfilling similar KYC requirements across multiple platforms is a mind-numbing task. With financial security regulations tightening around the world, KYC procedures are set to get even more tedious. Until recently, this was the only way — until the advent of something new. Blockchain. A completely secure, heavily encrypted, tamper-proof and decentralized, method of data management.

What’s Wrong With KYC Now?

The Know-Your-Customer process is an important one and involves several parties. There’s the customer, the financial institution, and central authorities. The information is relayed between these parties and independently checked in a lengthy process. First, the customer must manually upload basic information about themselves and their business. Next, the financial institution must collate, organise, and check the data against government records. Then, the customer, the business, its affiliates, and funding are all risk-assessed against central lists. These include criminal activity, financial fraud, terrorist activities or affiliations, illegitimate cash sources etc.

Blockchain-Based KYC

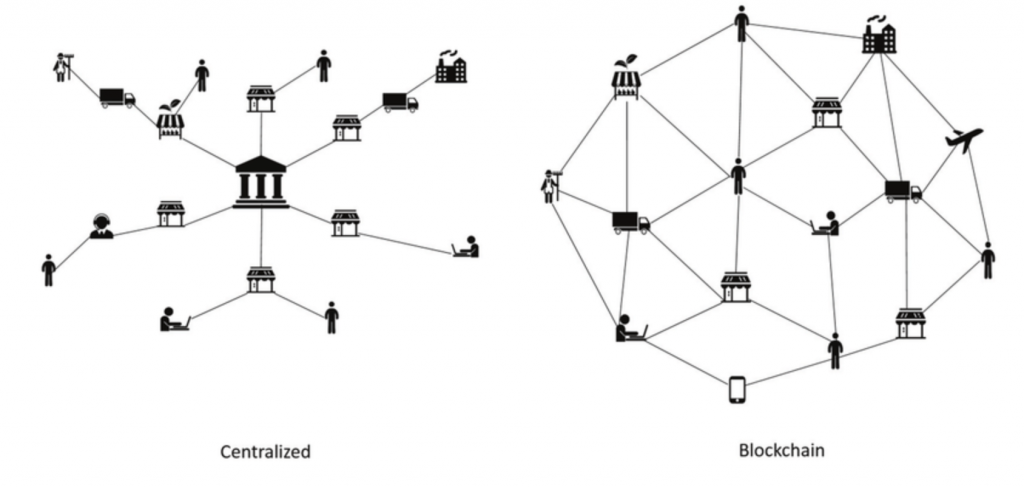

Blockchain technology, the foundation of the new Web3.0 era, is the answer to these KYC woes for institutions and customers. The blockchain runs on DLT or Distributed Ledger Technology. This means that data — such as a user’s KYC profile — is broken into encrypted ‘shards’. These shards are then distributed over decentralised nodes all over the world. Thus, they cannot be read without permission, edited, tampered with, or deleted.

This KYC data is verified and assigned a hash code by one financial institution. A digital copy is saved on the user’s KYC profile with a matching hash code. If another institution wants to verify the user, the user only has to give them access to this profile. The institution only has to check the hash code on their profile against the one provided by the original KYC institution. If the codes match, they know the KYC information is complete and verified. If not, they are alerted of potential fraud or suspicious activity.

The Advantages of Blockchain-based KYC

Having KYC data in one unhackable, decentralized ledger is better for both users and institutions, as it eliminates repetition. The user saves time and effort, and the institution saves money and time spent onboarding users. Here are a few ways in which blockchain is transforming KYC for the better:

Authenticity

The blockchain records and permanently stores the records of all data alterations in real-time, enabling checks to be put in place for suspicious activity that are essentially automatic. The data is also transparent (with permission access) and immutable, making it trustworthy. This reduces human error and oversights and best fulfils the function KYC is created for — knowing your customer.

Security

As data on the blockchain is stored in distributed shards, there is no one point for a hacker or other bad actors to attack. This makes the blockchain and data stored on it essentially unhackable. From the user’s side, as ledger access is strictly permission-based and automated, they can rest assured that their data is not being accessed, stored, or used for purposes they have not agreed to.

Automation

Getting a new passport or driver’s license in the old KYC system would have meant manually updating your KYC information on every single platform you use. Now, the user updates their KYC profile and programs called ‘smart contracts’ automatically update the information on the blockchain and alert institutions to update any stored copies they may have.

Time and Money Saving

Using DLT means that institutions can access a previously assembled KYC database instead of creating, storing, and updating their own, saving countless man hours and over a billion dollars globally. For users, it means they have just one KYC profile and a greatly shortened process for engaging in financial and business transactions.

A Blockchain-based KYC platform

Although blockchain technology and solutions are proliferating worldwide across every sector, consumer products based on them are just beginning to trickle into the marketplace. For the reasons mentioned above, a blockchain-based KYC platform is invaluable and vital to fostering trust in transactions.

One such platform is ClassifID. ClassifID is a dApp (decentralized app — a blockchain-based application) that allows a user to connect multiple Web3.0 wallets (e.g. Metamask, Coinbase etc.) and have them verified. Each wallet is tagged uniquely and verified on a one-time basis. After this initial process, any financial institution or business wanting to conduct a transaction with the user can access their ClassifID KYC profile and receive a KYC report that they can trust.

This can be used for any kind of verified asset transaction, allowing the user to sidestep red tape and engage in consumer activity from buying NFTs, or buying metaverse assets, to voting for a DAO (decentralised organisation). The best part of ClassifID is that through this one-time process, one can ensure their KYC details are compliant with financial institutions and businesses in multiple countries across the world.

In a budding financial system like Web3.0 and cryptocurrencies, the legitimacy of a user, their data, and finances is paramount. With an airtight measure like ClassifID’s verified KYC profiles, problems like fraud, money laundering, and illegitimate transactions are of no real concern. Users meanwhile, can escape the archaic KYC system and save time while still complying with regulations across the board.

The Future of Finance

Blockchain-based technologies are poised to transform every industry, particularly the financial sector through technological advancements. Greater security for both institutions, governments, and users coupled with time and cost being cut will lead to financial systems more robust, efficient, and fast than we currently imagine. Blockchain-based KYC is the perfect solution to the important and difficult problem of customer verification and trustable transactions. With a consumer dApp like ClassifID, everyone is set to win while adhering to the regulations even closer than before.